10. Today’s HR tech landscape

2017-03-22

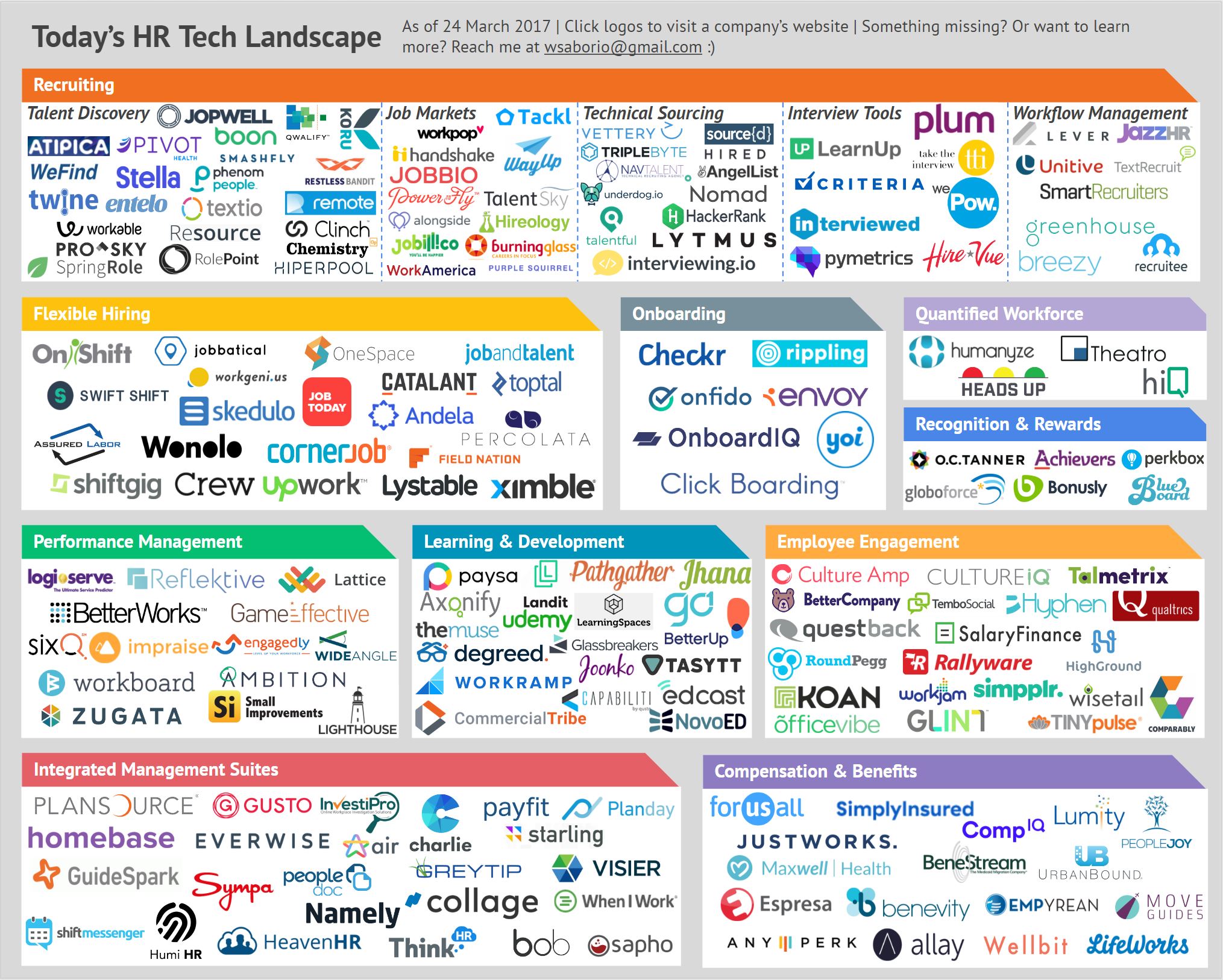

On the heels of my recent overview of what’s going on in HR tech, I thought I’d better understand the startups working in the space. Through conversations with multiple investors and founders in the space, and with help from tools like PitchBook, CB Insights, and communities like Product Hunt, I’ve developed a landscape of early stage HR tech activity.

If you’re pressed for time, here’s your tl;dr:

- 1. Recruiting is a big, crowded space that seems ripe for experimentation

- 2. Onboarding and performance management platforms look like new bright spots

- 3. Expect companies to gradually expand their product offering and migrate to the integrated management suite model (‘cuz that’s where the cash/moats are)

The early-stage HR tech landscape

The map is by no means exhaustive but reflects what I’ve found as of today, 22 March 2017; I’ll update this shared Google Slide as I find more (reach out to wsaborio@gmail.com if I missed something). I’ll also note I have a dataset capturing all these companies, and more, along with some notes about their product, fundraising, and investors.

A few comments about the map. First, I’m focusing on B2B startups, and analyzing this “HR enterprise stack” through an HR department’s functions, which I briefly define below. Of course some companies work across functions, but for the most part they’re quite contained:

(To get a sense of these functions’ scale, check out this survey conducted by totaljobs into how a high-performing HR department spends its day.)

Second, I’ve tried to focus on early-stage companies, and have avoided mapping young companies that have either reached late growth stages, been acquired, or have gone public (and there are a number). Of course, I’m also leaving out the industry leaders like SAP, Workday, etc.

Third, to limit the scope of this some, I’m focusing mostly on U.S.-focused companies.

What’s going on

My last post laid out broad trends in the HR tech space, but here’s what seems noteworthy among startups:

Recruiting is going nutsWow, there are a lot of recruiting companies. This might make sense, as the need is big, and there are many ways of skinning the talent cat, particularly with new tech. It also reflects the broader industry: while employment & recruiting agencies generate $28.5 billion in revenue, market share concentration is pretty low, with LinkedIn leading with about 5% of the market.1 Traditional recruiting is losing ground quickly to tech-enabled services, especially as the latter grow their business through acquisition. Acquisitions are likely to continue, as the network effects of a digital placement service are pretty clear. I’m guessing there will be a handful of general marketplaces leading the way with some companies carving niches for themselves (e.g., technical recruiting, designer recruiting).

That said, companies are taking interesting approaches to cracking the recruiting nut. Referral tools like Boon and RolePoint empower a company’s employees to be their recruiters. Discovery platforms like Stella and Resource use algorithms to sift through candidates and opportunities to serve up the best fits. Other tools like Lever and Greenhouse simply make it easier to manage the hiring process. In any case, there’s probably not a one-size-fits-all solution, meaning there’s room for experimentation.

Emerging trends in onboarding and performance managementAs more people will be recruiting and job-hopping, more people are going to be onboarded to those jobs. A group of companies are looking to automate document collection, background checking, and information-sharing to minimize job-changing frictions. A fair amount of money is flowing into the space, and there could be good reason: background checks alone are a $2 billion market2, but the real sweet spot is the promise of reduced churn, attrition cost, and automation of an arduous, paper-intensive process.

Performance management is another exciting space. More tools are popping up to improve the broken employee assessment cycle I discussed last time. Performance management SaaS is a relatively new space, with lots of potential not only from a market perspective (i.e., practically all companies have a need for this) but also product (e.g., goals and feedback information are rich datasets for measuring engagement, providing learning & development services).

The appeal of one-stop shoppingSpeaking of product expansion, I’d keep an eye out for startups that can over time successfully increase the scope of their tools and become integrated suites. Owning more of a company’s HR workflow, and more of the data around each employee datapoint, makes an integrated platform much stickier than a function-focused tool. (This is probably less true for a recruiting platform, which is ultimately more concerned with information of people outside of a company rather than in it.)

With that in mind it’s no wonder companies like Namely and Gusto started in one space (insurance brokerage and payroll) and then included core HR tools: from their perspective, broker fees offer a sustainable cashflow upfront, but more importantly from a customer perspective, SMBs and oftentimes enterprises don’t look for performance management + rewards + engagement solutions; they want an HR platform. It’s one reason why companies that can afford it turn to the SAPs of the world. It’s why technical integrations across all these platforms are so crucial for customer adoption. (Startups like Humi HR and Collage are all-in-one out of the gate, which feels like a great solution for early-stage customers, but it’ll be interesting if they can move up-market as quickly as the function-focused, say, broker companies.) Expect companies to move to that bottom-left corner of the map; it’s where the $643 billion global pot of HR money is.3

Conclusion

Well that should give you a sense of who’s doing what in HR tech. I’m personally pretty excited about the future of the workplace, but I’m also curious to see how these companies will win — I’ve spoken to a few founders and investors and it’s clear challenges remain. For instance, how important is brand-building? (First take: Very.) How important is educating the HR office? (Instrumental.)4

At any rate, feel free to give a shout at wsaborio@gmail.com if you’re working on something cool in the HR space, or want to chat about this stuff — I’m always curious to learn more.

[1] IBISWorld. “Employment & Recruiting Agencies in the US.” 2016.

[2] IBISWorld. “Background Check Services in the US.” 2016.

[3] IBISWorld. “Global HR & Recruitment Services.” 2016.

[4] For more on this, check out this awesome report from the Starr Conspiracy: Why HCM Tech Startups Fail.